Shopify Payments: Accept Purchases Directly From your Online Store Without the Headaches

Table of contents

- Why Shopify Payments is So Important

- What is Shopify Payments?

- Where is Shopify Payments Available?

- Open Up to the World with Shopify Payments

- How Do I Set Up Shopify Payments?

- Simulating a Transaction

- Shopify Payments for Mobile Purchases

- Shopify Payments Fees

- Shopify Apps to Supplement Shopify Payments

Ecommerce is on course to become the dominant way for retail consumers to make purchases in the near future. This is due to the accessibility and variety of products and services available at their fingertips. Systems like Shopify Payments are designed to enable consumers and business owners to buy and sell globally.

The potential to tap into such a colossal market is incredibly enticing for business owners, but it may also be a concern for those who are not familiar with how ecommerce works.

How do I get paid? What are the fees associated with international purchases? How do the taxes work? Is it secure? What payment methods are available to my clients?

These are only a handful of the questions one might have when making the decision whether or not to conduct business online. Shopify Payments is designed to take care of all these concerns for you.

Why Shopify Payments is So Important

The fact is that it is quite complicated doing business, especially internationally, over the internet. There are considerations that need to be made beyond what was necessary with brick and mortar retail outlets. It’s important for an entrepreneur to be able to focus on growing their business, and they need to generate revenue to do so. Therefore, quickly and safely receiving the proceeds or profits from the products or services they sell is essential.

Thankfully, Shopify comes to the rescue once again. Shopify’s philosophy has always been to simplify the more onerous aspects of ecommerce so the business owner can focus on building their brand and making sales.

Another major consideration is the sheer volume of ecommerce purchases made from mobile platforms. These users value convenience, so payment integration like Shopify Payments is a major factor in allowing those consumers to safely and efficiently buy your products.

“According to current reports, at present only about 1.6 billion people use their mobile devices to shop online globally. However, by the end of 2017, over two billion mobile phone or tablet users will make some form of mobile commerce transaction. 95% of mobile internet users look up local information on their phones for the purpose of calling or visiting a business. Presently, mobile devices account for 19% of all US retail e-commerce sales. This figure is estimated to reach 27% by the end of 2018, which represents 1 out of every 4 US retail e-commerce dollars.”

[Shukairy, 2016]

The Shopify Payments system is in place to help you avoid any unneeded complexities when getting paid through your online store. With Shopify payments, there is no need to rely on third-party services* and the payment system is completely secure.

*Third-party payment gateways are required for countries outside of the list below

What is Shopify Payments?

There is nothing more frustrating than experiencing the excitement of finding the perfect products, placing them in your cart, proceeding to checkout then….. “Unable to process this transaction”. I have personally endured this grievous injustice many times, especially when trying to purchase airline tickets. But, I digress:

“Shopify Payments is the simplest way to accept payments online. It eliminates the hassle of setting up a third-party payment provider or merchant account and having to enter the credentials into Shopify. Shopify Payments comes fully integrated with your store and includes a wide variety of functions that let you manage your entire business and financials in one place.”

[Shopify, 2018]

Shopify Payments allows you to accept payment for orders via credit card directly from the checkout on your store. Visa, MasterCard and American Express are all supported natively.

“Shopify Payments can accept Visa, Mastercard, and Amex debit cards in Canada, the United Kingdom, Ireland, Australia, New Zealand, and Japan. In the United States, you can also accept JCB, Discover, and Diners Club debit cards.”

[Shopify, 2018]

The system offers flexibility in Shopify core countries so business owners do not need to worry about losing customers due to payment frustrations.

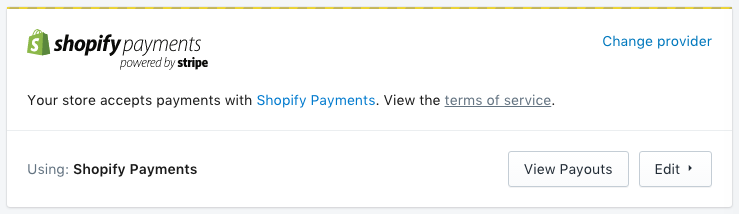

Shopify Payments is powered by Stripe, a technology company whose software provides the technical and financial infrastructure needed for payment systems to operate.

Where is Shopify Payments Available?

Shopify Payments is currently available in the following countries:

- United States (Not US territories except Puerto Rico)

- Canada

- United Kingdom

- Australia

- Ireland

- New Zealand

- Singapore

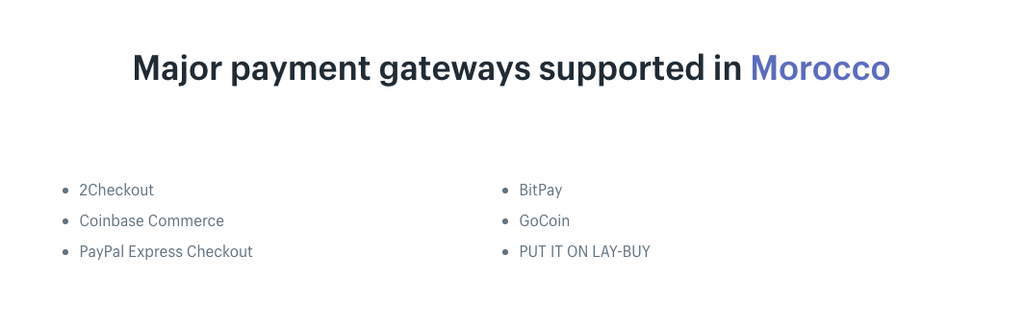

In addition to these core countries, more than 100 third-party payment gateways work with Shopify to ensure that credit cards can be accepted through Shopify stores all over the world. The list can be viewed here.

If you don’t find your country on this page, there are still solutions. For example, Morocco is not listed on this page, but if I do a quick Google search for “Shopify payments gateways Morocco” I can discover exactly what integrations are available.

Open Up to the World with Shopify Payments

The most important thing for you to remember as a business owner is that Shopify will allow you to sell on a global scale. No matter what your country of origin is, there are tools for you to make sure that your products are available to consumers around the world.

Shopify will give you the ability to make your store available in different languages, purchases to be made in foreign currencies, global shipping solutions and much more.

So let’s take a look at Shopify Payments, another incredible integrated feature of the Shopify platform.

How Do I Set Up Shopify Payments?

The only requirement for setting up Shopify Payments is to have a Shopify store in one of the designated and supported regions. If you are outside these areas, you will need to rely on a third-party payment gateway. Take a look at the guide here.

To set up Shopify payments, you’ll just need the following information:

- your Employer Identification Number (EIN)

- your banking information

- the average price of your orders

- the average shipping time of your orders

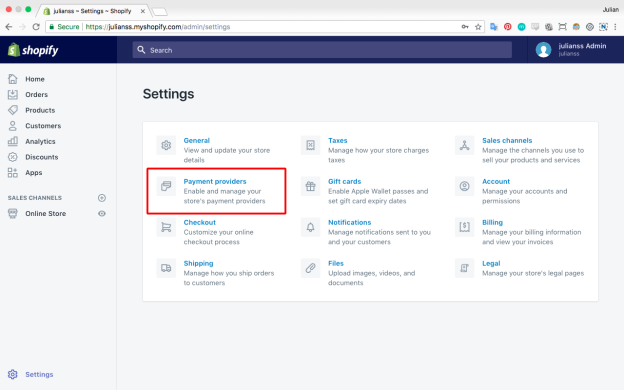

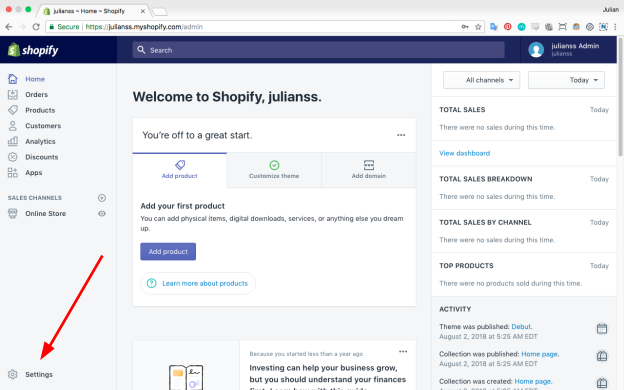

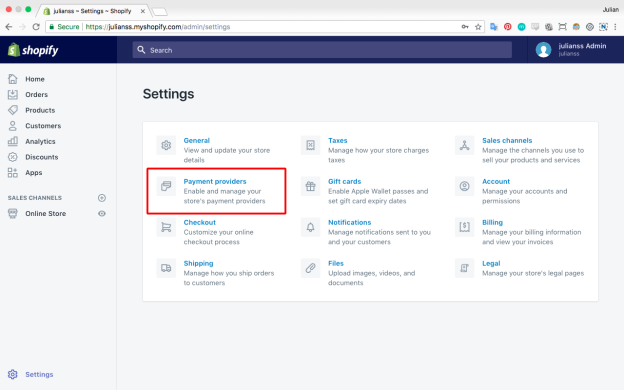

Once you’ve compiled this info, head to your Shopify Admin dashboard and select setting on the lower left. After, you can select “payment providers” in order to configure your preferred settings.

Unfortunately I’m quite limited to what I can show you as a demo for configuring Shopify Payments, but keep reading below for the “Simulating a Transaction” section to get a good idea of what the menus and options look like when you’re setting Shopify Payments up.

There is also a great guide straight from the Shopify Help Center here.

The final question, of course, is how does a merchants get paid for these transactions:

“Shopify Payments is the simplest way to accept payments online. It eliminates the hassle of setting up a merchant account with a third-party payment provider, and then entering your account credentials in Shopify. Because Shopify Payments is fully integrated with your store, you can view your payouts directly in the Shopify admin.

If you are using a third-party provider, then you won't see your payout information in the Shopify admin. Third-party payment providers have their own ways of displaying your payouts. Check with the service you are using to find out how they display this information. For an overview of how payments work with Shopify, see Getting Paid.” [Shopify, 2018]

As you can see, the integration with your store makes it very clear what your payout will as all the associated fees are automatically deducted. Payment gateway users will need to set up a merchant's account in order to receive their payout from sales on their store. More information on both processes can be found here.

Simulating a Transaction

Shopify Payments offers merchants the opportunity to test if their payment system is functioning correctly on both desktop and mobile. There are two ways of doing this:

- Shopify Bogus Gateway (actual name)

- Place, then immediately cancel an order with a real payment provider

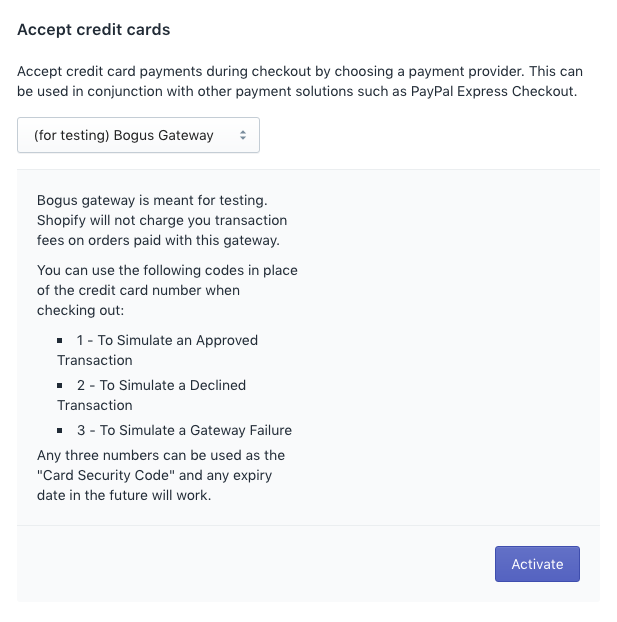

To use the Bogus Gateway, first navigate to your Shopify Admin dashboard, then select “settings” on the lower left.

Then select payment providers.

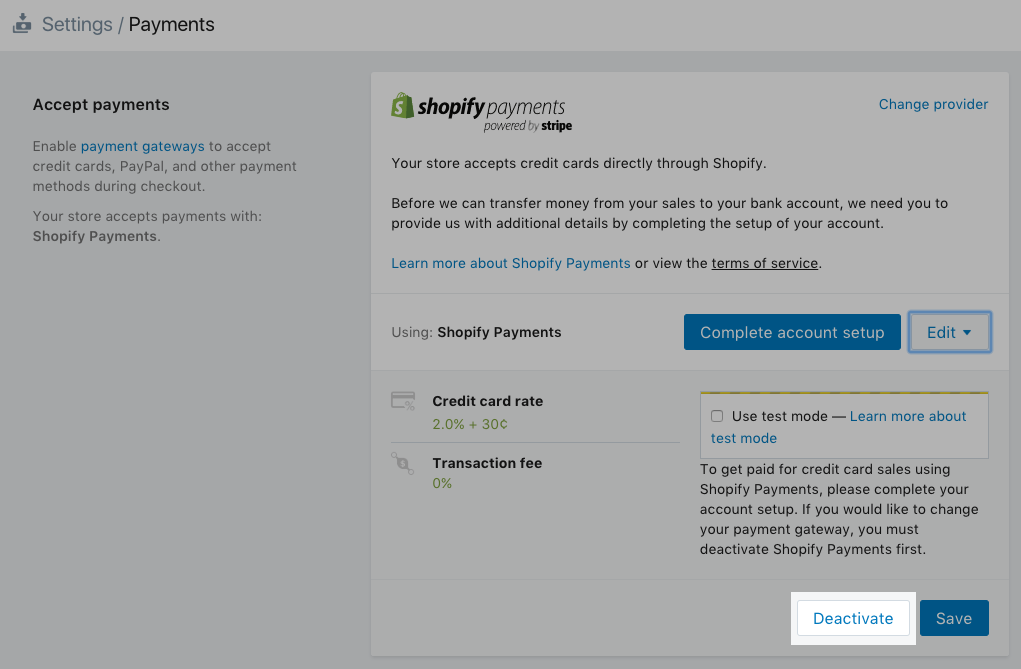

If you already have a credit card provider chosen, deactivate is by clicking “edit” then “deactivate.

At this point, you’ll want to click on the provider dropdown menu and select “(for testing) Bogus Gateway an hit “activate” at the bottom right.

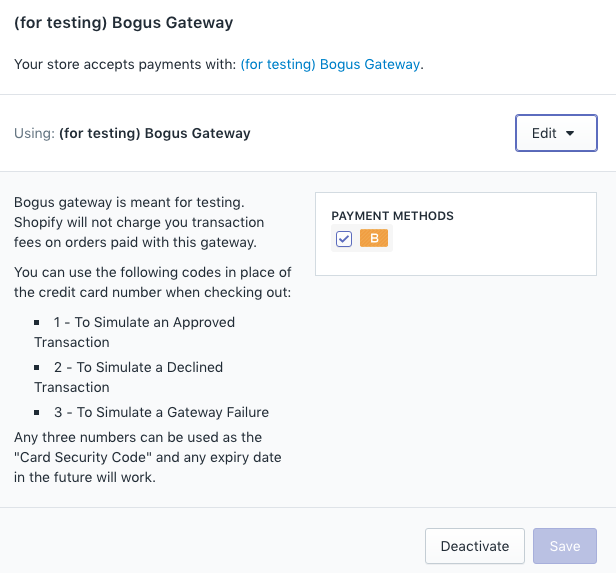

Now your Shopify Payments settings have been correctly adjusted so the Bogus Gateway will apply to your actual store.

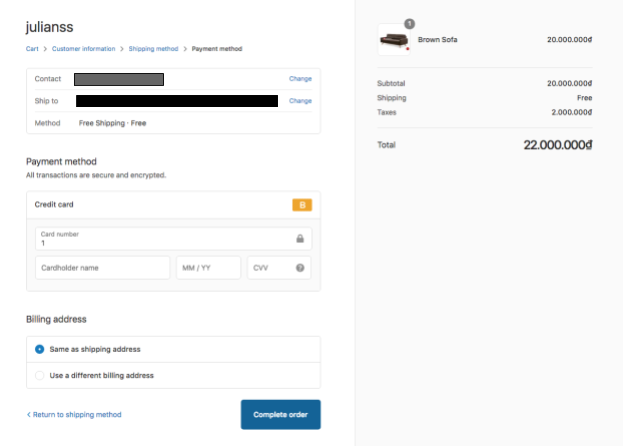

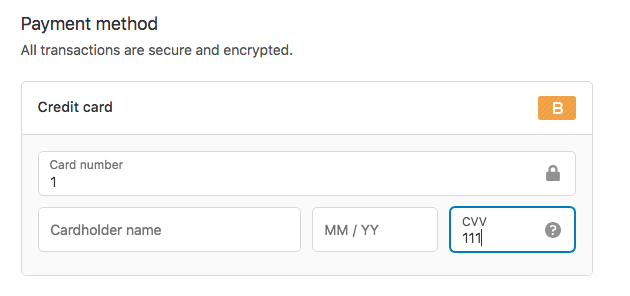

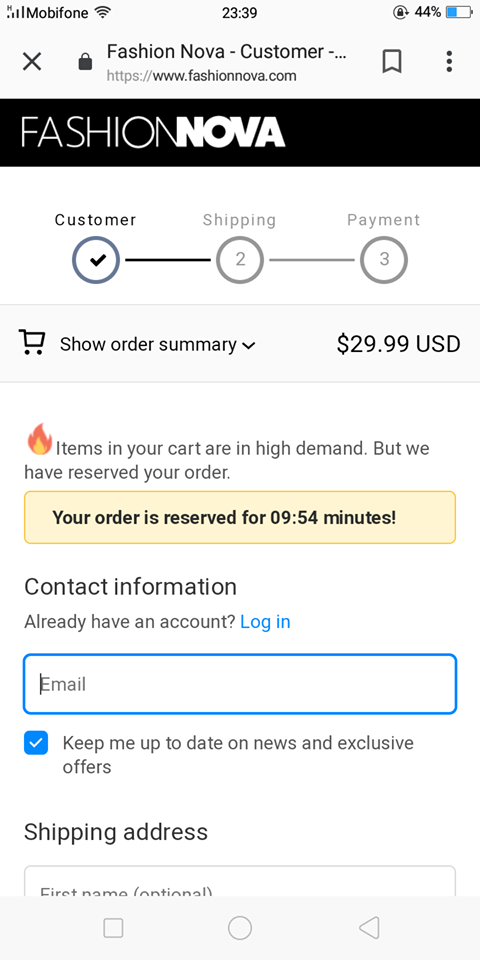

Now to test a transaction, follow the method in the above photo. First, navigate to your store and proceed to the checkout as a regular customer would.

After filling out the Customer Information and Shipping method, you will arrive at the Payment method screen.

Here, when filling out the credit cards details, you can input your name or the name matching the customer information at the beginning of the order, and any expiration date and CVV will work.

Instead of using real credit card information, you can use the following codes in place of the credit card number when checking out:

1 - To Simulate an Approved Transaction

2 - To Simulate a Declined Transaction

3 - To Simulate a Gateway Failure

Any three numbers can be used as the "Card Security Code" (CVV) and any expiry date in the future will work.

In this example, I used the code “1” to simulate an approved transaction.

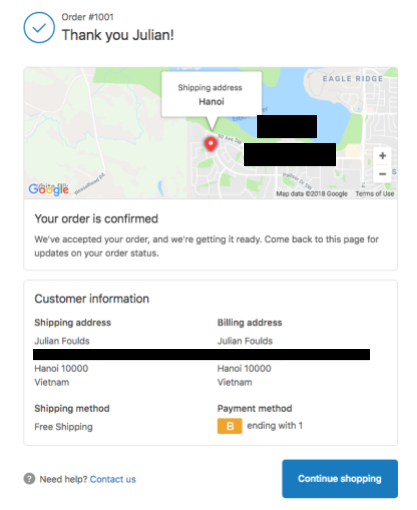

If you have correctly followed these steps, you will be greeted by the following screen:

Some information has been intentionally omitted

Don’t worry if something hasn’t gone correctly, there is no way for you to be charged during a test transaction, and there is zero risk of any real money being charged as there is no real credit card information put in.

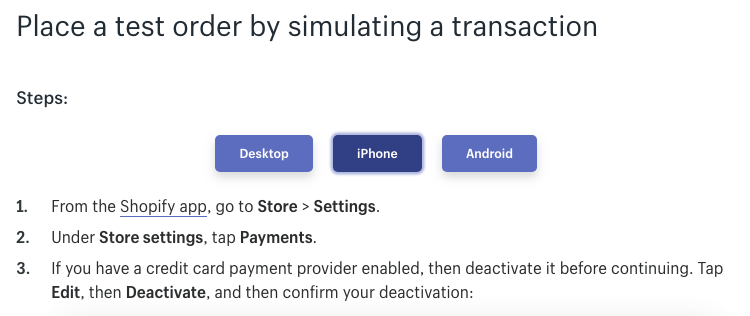

If you want to place a test order on mobile, visit this link and select “iPhone” or “Android” and follow the steps below. The process is very similar with some minor differences in menu options.

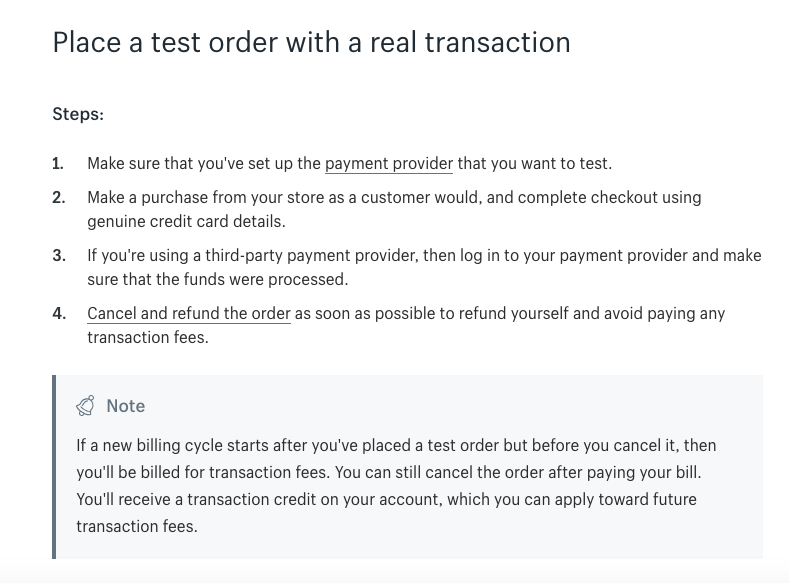

The second method is by placing a test order with a real transaction. Follow the guide here in order to do so.

Although the steps are simple, be certain that they are followed correctly and that you cancel the transaction immediately after making the purchase.

Shopify Payments for Mobile Purchases

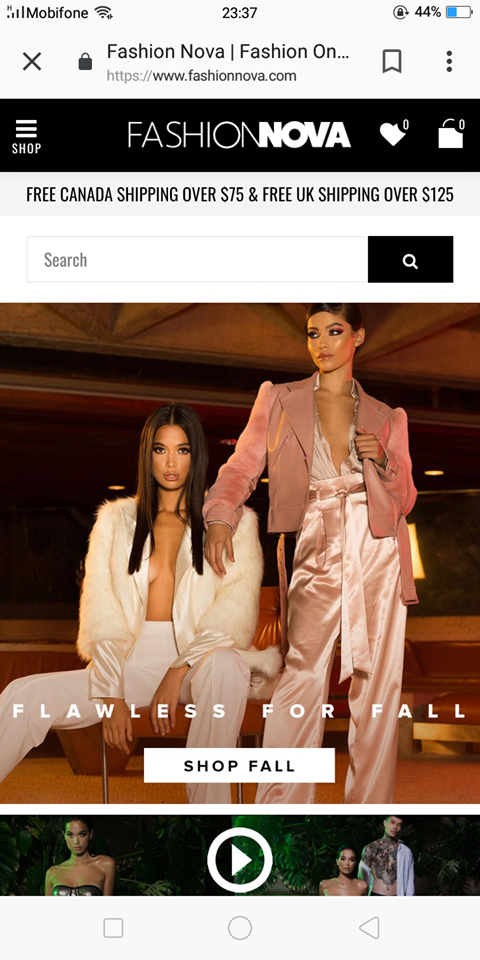

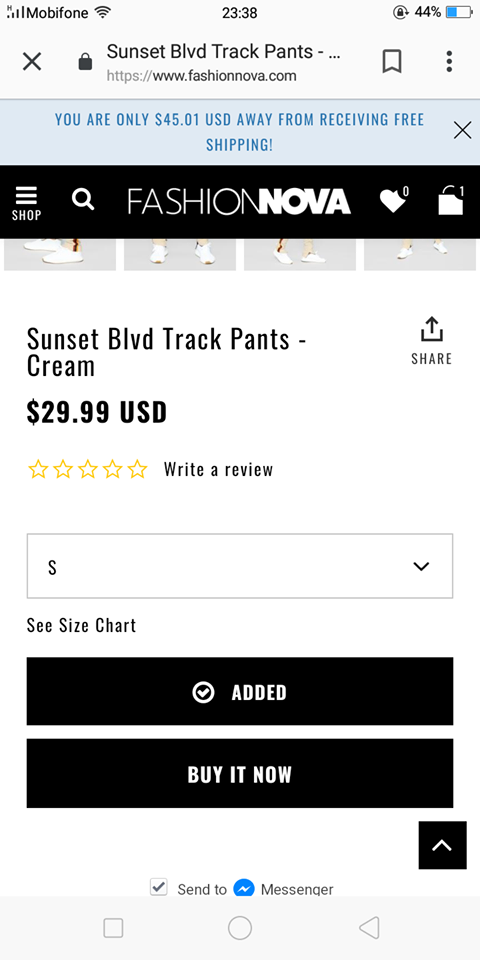

Shopify Payments is optimized for the mobile interface as well. The layout is responsiveness and intuitives, and the checkout process is super easy as well.

One thing I was very impressed with was the speed of the checkout process with Shopify Payments on mobile.

Take a look below for some screenshots of my experience checking out from my smartphone.

Could I rock those pants? I don’t think it would be a pretty site……

As you can see I was taken easily from the homepage, to the product page, checkout then customer info with a beautiful layout and super fast response. This is great because so many consumers are shopping from their phones and tablets that as a merchant, you want to avoid any unnecessary frustrations with the functionality of your store. Hurray for Shopify Payments!

Shopify Payments Fees

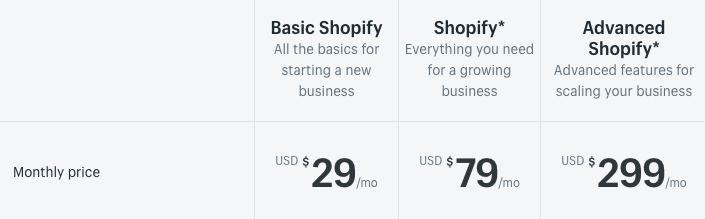

The way that fees are charged depends on a few things:

- Location

- Shopify Plan

- Sales Volumes

As you can see in the image, Shopify Payments users are charged a certain percentage which descends as you move to a more premium plan. Additional fees are associated when merchants need to use payment gateways. Check the complete list and pricing breakdown here.

Basically there is a slight variance amongst the first three, and a larger drop when going to Shopify Plus (which starts at $2000 per month). The reason this break is given to Plus merchants is because there are extremely high-volume, efficient stores.

Individuals that opt to use Shopify payments in addition to third-party gateways will still be susceptible to additional fees. For example, if you wanted to add a PayPal gateways to your store, you would need to pay the additional 2, 1, and 0.5% respectively for each plan.

For PayPal, merchants must also register a business account with them in order to connect Shopify and PayPal.

The main things to remember:

- The better the plan, the lower the credit card fees, but the higher overall cost of the plan

- Shopify Payments is only available in the countries listed earlier in this article

- Merchants using payment gateways must pay the Shopify Payments fee as well as the additional third-party fee

Just assess the needs of your business to decide what we be the most suitable plan of action based on the size you currently are. For help deciding which plan would be the most suitable for you business, check out our Shopify Pricing and Plans blog post.

Shopify Apps to Supplement Shopify Payments

There are some amazing apps that will supplement not only your store, but make it easier and even encourage customers to make purchases during their visit.

This is a brief list that applies to Shopify Payments, but I encourage you to take a look through the Shopify App Store for yourself.

Some of these apps have the following handy functions:

- Offer subscription-based payments - Recurring Payments

- Display prices is any different currency - BEST Currency Converter

- Monthly payment options - Partial.ly Payment Plans

- Sell directly from your Facebook page - Facebook Channel

- Split/Partial payments - Split Partial Payments

And many more.

A lot of these apps offer free plans so go ahead and give them a try.

Open your store and start selling risk-free today! Check out our guide for registering for free in under 5 minutes.

Read our complete guide to Shopify:

As always, let us know if you have any questions below!

Happy selling, bonne chance!